What or who caused the economic collapse of Sri Lanka

Sri Lanka’s economic debacle is a collective result of embracing capitalist consumerism, importing more than exporting, spending more than earning, taking loans to continue artificial lifestyle & taking more loans to pay the loans & not utilizing loans for viable alternative return-on-investments. Alongside this reality was another more important & ignorant fact. Elected governments could not lead because they lacked the will to stand up to or form a strategy to deal with geopolitical bullies interfering in the internal affairs of Sri Lanka & dictating how Sri Lanka is run. The outcome of this has resulted in Sri Lanka being distanced from its traditional non-bullying friendly nations, local pimps in various public & private positions choking Sri Lanka’s development & forcing Sri Lanka to pursue what benefitted geopolitical interfering parties.

This is what took place in 2015 after pivot to Asia took a new twist, with West & India adding another set of debacles to what Sri Lanka experienced since 1948 with their covert/overt nod of approval

- Tamil leadership quest for devolution to later become confederal

- Catholic Action that continues still

- JVP rebellion using Sinhala youth to kill Sinhalese

- LTTE terrorism to eliminate nationalist leaders (Sinhala/Tamil)

- Communal divisions

- Political instability

- All that was missing was economic instability.

With LTTE eliminated, external influencers lost a key tool, they turned to UNHRC however that did not prove too successful, then regime change in 2015 stepped the tempo

- India signing to QUAD

- Sri Lanka signing ACSA with SOFA and MCC lined up

2015 Regime change returned Ranil to power after a gap of 10 years as Opposition Leader.

2022 Aragalaya returned Ranil as PM.

If regime change was meant to bring ‘their’ man to be PM, it is obviously with ‘their approval’ that the rest of the team was appointed & entire economy was put under ‘their PM’.

“Their PM” had the Central Bank brought directly under him from the Finance Ministry with Governor reporting directly to PM.

‘Their PM” became the Minister of Policy Planning, Economic Affairs & with CBSL they were to liaise with the international donors and financial institutes. CBSL no longer had exclusivity in planning policy.

The Monetary Law Act, Exchange Control Act, Banking Act & Loans Recovery Act were all brought under ‘their PM’.

The Governor CBSL was ArjunaM former BOI head when RaniLW was PM in 2001 who exiting after 2 Bond Scams.

Indrajit Coomaraswamy became Governor (Jul2016-Dec2019). He too was advisor to PM Ranil in 2001, as well as advisor to Milinda Moragoda Minister of Economic Reforms, Science & Technology (2001-2004) & head of Pathfinder where Coomaraswamy was a key member. Coomaraswamy was also alumni of LIRNEasia chaired by Prof.Rohan Samarajiva & special advisor to Malik Samarawickrema Minister of Development Strategies & International Trade in 2015 before becoming Governor. He & his sister Radhika Coomraswamy are non-executive directors of John Keells, ADANi’s partner in Sri Lanka for West Terminal.

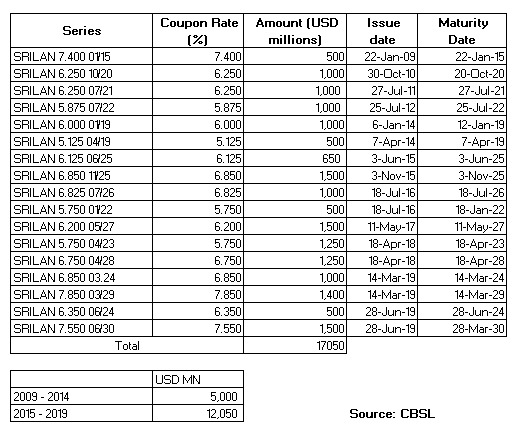

Coomaraswamy & Nandalal sold USD 5 billion in total between 2015 to 2019 to defend the exchange rate using borrowings with IMF blessings

Thus the entire monetary apparatus placed under control of PM Ranil from 2015-2019 functioned on advice of IMF and other international monetary advisors.

It was under their watch that a plethora of corruptions took place and internal systems were exposed & made vulnerable.

Inspite of 2 Bond Scams the foreign friends propped Sri Lanka’s ‘income status’ to meet criteria required to sign MCC after the Easter Sunday shockwave.

Did regime change operators handover Hambantota Port to China for $1.12b for 99years as a consolation prize against what US & India were planning to secure?

Did these external parties & international monetary institutes who were closely associated with the ‘experts’ in the yahapalana govt & CBSL advise taking $12b ISBs as part of a bigger plan to economically stifle Sri Lanka?

In this context it is baffling why the same experts Coomaraswamy & S Devarajan who are architects of the failed Pathfinder post-covid economic plan for Sri Lanka would be picked as Presidents economic advisors?

As we understand, even after covid outbreak, Sri Lanka paid loans, paid interest, paid roll-over maturity debt, paid for fuel, coal, medicine, gas, food & cleared imports in 2021.

So what was the problem in 2022?

We are also made aware that out of $7b loan payment due in 2022, Sri Lanka paid $1166m in March. Sri Lanka was due to pay $1033m (for April-May-Jun) What was the problem paying this when Sri Lanka’s export earnings were $750m & there was a roll over SLDBs of $363 & China was to provide a cash loan of $1b & trade loan of $1.5b as well as an Indian credit line of $1b and an additional $500m?

Have regime change operators tapped present government as well.

Was regime change operators responsible for the 12th April 2022 declaration by Finance Minister Sabry & new CBSL Governor Nandalal to unilaterally declare default payment of all loans without monetary board recommendation, without Parliamentary or Cabinet approval especially when Parliament had approved repayment of forex debt in 2022 budget?

Who gave the nod for Minister Sabry & Governor Nandala to virtually declare Sri Lanka bankrupt completely bringing Sri Lanka to naught and triggering a shocking effect on our nation. Both must take individual responsibility for the shame placed on Sri Lanka for declaring Sri Lanka bankrupt. Was this intentional or were they made to say so & why?

Did they not think that by declaring there was no forex to pay loans, this meant there was no forex to buy essential supplies too?

https://www.ft.lk/business/Leaders-of-Ceylon-Chamber-top-economists-speak-out-on-forex-crisis/34-728960 (business leaders also say to default)

Their declaration resulted in nullifying confidence in Sri Lanka to pay, triggering rating agencies to place Sri Lanka at default status, no country/supplier was ready to give us anything without paying upfront, banks had lost credibility to borrow and the twosome had stopped any avenues for Sri Lanka to seek loans and people were left in queues.

While Sri Lanka has to pay $7b in 2022, Sri Lanka is seeking $3b from IMF which is hardly likely to solve Sri Lanka’s problem and it is baffling why from the Governor downwards can only say “Sri Lanka should have gone to IMF”.

Do we need a CBSL or Finance Ministry or PM if their only solution is ‘go to IMF’?

Sri Lanka has gone to IMF 16 times and followed advice of IMF and worked its budgets according to IMF, but where has IMF taken Sri Lanka?

IMF mantra has never changed – cut subsidies for the poor, privatize, depreciate rupee as conditions for loans. IMF loans end up a bitter solution with greater repercussions & prevents nations from finding viable alternatives to address debt. The situation is made worse when Ministers in charge and CBSL also chant “IMF” too. Let us also not forget that every budget is also given nod by international monetary institutions or perhaps even drafted by them

We have a situation where a govt elected via a regime change who installed puppets to carry out a larger agenda (maximizing on an already piling historical budget deficit), precipitated another with the issuance of $12b ISBs, then came covid & Easter Sunday attacks, which left Sri Lanka with $1.93b reserves & revenues going haywire in 2021 & yet even in April exports had hit $915.3m with things looking up for Sri Lanka.

Yet stage was set for an economic crisis part of which was the takeover of assets & turning Sri Lanka into a vassal state with people having nothing to defend and brought to the level of not wanting to or able to defend their resources because hunger was more important. The attacks on the politicians was a subtle message of what to expect if they did not toe the line.

https://www.piie.com/blogs/realtime-economic-issues-watch/imfs-harmful-debt-restructuring-proposal

The 3 main triggers for Sri Lanka’s collapse

- Depreciation of Rupee (Free floating of rupee – pre-requisite of IMF – Article 4) resulted debt serving increased, cost of living increased, inflation, increasing taxing,

- Cost of inflation & production increased

- Cost of debt increased

- Significant losses to banks running negative open positions to finance imports of SL

- Interest impact hit banks – hit their investments in treasury bills and sovereign bonds as these had to revalued.

- Hiding gravity of IMF ‘restructure’ & fooling people with words.

- 12 April declaration of default on debt interest payment of $50b to foreign creditors by Minister Sabry & Governor Nandalal – damaged investor confidence, made it difficult to borrow money from international markets, banks suffered losses, access to trade comes to standstill, every monetary line is frozen.

https://www.adb.org/sites/default/files/publication/28044/bn005.pdf

Did the regime change operators also prevent Sri Lanka from going to China, Russia and other friendly nations to secure a relief package & instead wanted Sri Lankans to suffer further entering as ‘saviors’ to buy off all our assets to obtain loans for which we have nothing to make revenue to pay interest.

Shenali D Waduge