IMF loans & Sri Lanka: Bartering whatever resources we have left

All IMF loans come with conditions. The requesting country submits a letter of intent with its economic plan & that plan is not what the country proposes to do with the loan but only a plan to recover & repay the IMF loan. All loans generally request countries to siphon off their national resources/assets & cut welfare measures given to the people. How many countries have developed as a result of IMF loans against how many countries are suffering as a result of IMF loans, is a question not difficult to answer.

Loan types are classified thus:

EXTENDED CREDIT FACILITY– is with zero interest & has a grace period of 5 ½ years & maturity of 10 years

STANDBY CREDIT FACILITY– is with zero interest with grace period of 4 years & maturity of 8 years.

EXOGENOUS SHOCK FACILITY– repayments made twice a year beginning at 5 ½ years & ending 10 years. Interest rates are reviewed every 2 years.

STAND-BY ARRANGEMENTS– 12-24months & repayment within 3-5years & given to middle-income countries.

EXTENDED FUND FACILITY– longer than SBA & repayment within 4-10 years

FLEXIBLE CREDIT LINE– Given for crisis prevention & repayment within 3-5years & a single-up-front payment.

PRECAUTIONARY CREDIT LINE– used only for crisis prevention repayment is between 1 to 2 years.

Are IMF loans worth taking & have countries benefited by taking IMF loans?

What good have IMF loans served a nation – have these loans helped reduce poverty & inequality or have IMF loans resulted in poor countries losing their natural resources & assets?

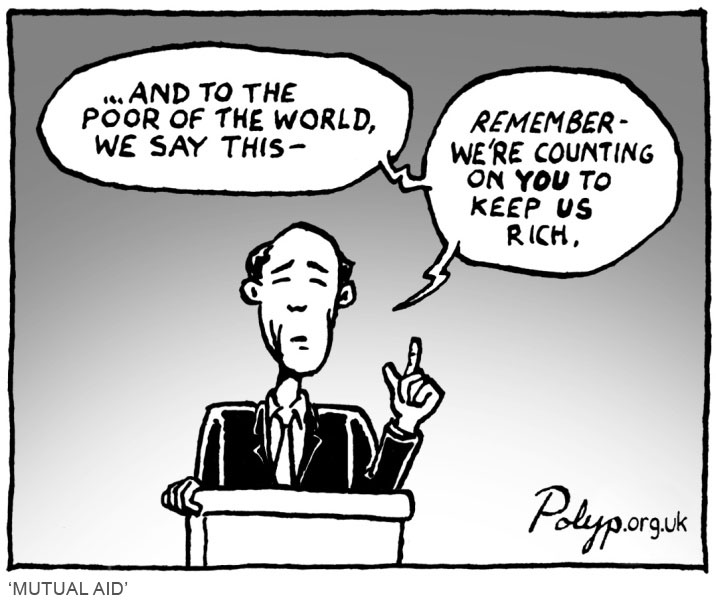

Structural adjustments have always been targeted at the poor & middle class – IMF has always demanded countries to reduce social welfare handouts & increase taxes on the poor. It is natural that the elite always canvass for IMF loans as neoliberal policies are all beneficial to them & their status quo. Human development is virtually at a standstill in countries that run to IMF for loans & abide by the conditions it imposes.

IMF loans forces countries to give up its assets/resources to take the loan? What good is it to take a loan which is dependent on what a country agrees to give up & then end up paying the loan with interest while losing a country’s national assets & cutting down on welfare measures to the poorer segments of society?

These neoliberal policies have not left any IMF-seeking country any better than what they were before running to IMF for loans.

IMF conditions attached to loans are a threat to the democratic rights given to the people as resources that belong to the State are siphoned off by a government who cares not that it is giving away State resources/assets & is only thinking of means to remain in power. As a result all of the protective measures of a State & its regulation bodies ends up thrown out the door in order to obtain the IMF loan.

However, taking away a country’s resources as part of a loan plan has not served any of the countries that have gone to IMF & all of these countries have only had to give up what belongs to the State. IMF & other international monetary bodies have only reduced the sovereign ownerships of states. With resources falling into multinational hands & away from national ownership, countries have had to only be reliant on further loans & more siphoning to survive. Such policies are short-term gains for struggling governments to remain in power but affords no solace to the people of a country. It is shocking that learned advisors & policy makers do not realize the long-term outcome of these short-term decisions unless they do not care because they will next be handing the headache to the next government coming to power.

IMF also encourages countries to borrow from other sources to repay IMF loans which lands countries in further chaos – ex: requesting loan from China & utilizing that to repay IMF/India!

IMF in reality is a body serving capitalism & elitism. It is not an entity aspiring to develop nations or combat poverty. In fact, countries taking IMF loans have not developed & are in dire levels of poverty as IMF favors complete liberalization of capital flows.

What do IMF bail outs mean? These entail nothing but structural adjustments, high interest rates, promoting PPPs in health & education (privatizing) IMF extracts from working people to pay for crisis created by big businesses. With currency getting devalued, inflation rises leading to subsidy cuts & taxes making cost of living unbearable for the poor.

Just like the UN has lost its sheen of legitimacy, the Bretton Woods institutions have nothing to show for its success in terms of raising the lives of the majority of people living in any country. These international monetary institutes certain have improved the lives of a handful of rich capitalists but no one else. Structural adjustments are not the answer – over periods of time national assets & resources have slowly & incrementally being taken from national ownership & passed off to multinational corporates whose policy is to make profit for itself. The handouts they are given are eventually paid for by the poorer segments of society whose benefits are cut & taxes end up increased making life all the more unbearable. A closer look at the financial deals these global financial institutes strike with debtor countries will reveal the true story.

Thus, it has been the neoliberal policies adopted since open economy in 1980s & unplanned loan taking that has left Sri Lanka facing the current financial/economic catastrophe. We have failed to devise ways to become an export-oriented country & have been satisfied to only import essentials & non-essentials. It is natural that over time we end up with higher expense than any revenue. Running to IMF & agreeing to further structural adjustments is not going to do the majority of people in Sri Lanka any good. IMF is only bothered about how its loan will be returned with interest & will agree only dependent on what national treasures Sri Lanka is willing to forfeit for that loan. With Sri Lanka’s national resources/assets now a handful under State ownership, governments will soon end up bartering the people too.

We are supposed to have economic advisors/consultants & policy makers – what have they been doing all these years! No one needs to be an expert to run off to beg loans from international monetary bodies & agree to their conditions to give up national resources/assets & cut welfare.

Shenali D Waduge